DEF 14A: Definitive proxy statements

Published on April 21, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Fellow Stockholders:

It is my pleasure to invite you to the 2023 Annual Meeting of Stockholders of Omega Healthcare Investors, Inc., which will be held on Monday, June 5, 2023 at 10:00 AM EDT.

Enclosed you will find a notice setting forth the items we expect to address during the meeting and our Proxy Statement. The Proxy Statement and our Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available electronically at www.proxyvote.com or www.omegahealthcare.com and are first being sent to our stockholders on or about April 21, 2023.

Your vote is important to us. Even if you do not plan to attend the meeting, we hope your votes will be represented. Included in the Annual Report is our 2023 letter to stockholders in which we discuss the progress we’ve made on our strategy, lay out our financial performance and explain how our people navigated a dynamic market environment to achieve our results.

I would like to personally thank you for your continued support of Omega Healthcare Investors as we continue to invest together in the future of this company. We look forward to engaging with our stockholders at our Annual Meeting.

|

C. Taylor Pickett Chief Executive Officer April 21, 2023

303 International Circle Suite 200 |

Notice of 2023 Annual Meeting of Stockholders

|

The Annual Meeting will be held: MONDAY, JUNE 5, 2023 It will be held virtually via live webcast at: virtualshareholdermeeting.com/ |

|

Proposals: 1: Election of eight members to Omega’s Board of Directors 2: Ratification of the selection of Ernst & Young LLP as our independent auditor for fiscal year 2023 3: Advisory vote on executive compensation 4: Advisory vote on the frequency of the advisory vote on executive compensation 5: Approval of an amendment to the Omega Healthcare Investors, Inc. 2018 Stock Incentive Plan to increase the number of shares authorized for issuance thereunder We may also transact any other business as may properly come before the meeting or any adjournment or postponement thereof. Director Nominees: |

||

Kapila K. Anand |

Craig R. Callen |

Dr. Lisa C. Egbuonu-Davis |

||

Barbara B. Hill |

Kevin J. Jacobs |

C. Taylor Pickett |

||

Stephen D. Plavin |

Burke W. Whitman |

|||

|

Each of the director nominees presently serves as a director of Omega. Attendance: Our Board of Directors has fixed the close of business on April 6, 2023 as the record date for the determination of stockholders who are entitled to notice of and to vote at our Annual Meeting or any adjournments or postponements thereof. On or about April 21, 2023, we will first send to our stockholders our 2023 Proxy Statement and Annual Report to Stockholders for fiscal year 2022. This year, we are again adopting a virtual format for our Annual Meeting. For further information on how to participate in the Annual Meeting via live webcast, please consult the section captioned “Quorum and Voting” on page 78 of this Proxy Statement. |

||||

|

Your Vote is Important: Whether or not you plan to virtually attend the meeting, please vote promptly using one of the below methods to ensure that your shares are properly voted. If you hold shares through a broker, bank or other nominee (in “street name”), you may receive a separate voting instruction form, or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone. | |||

|

Follow the instructions at www.proxyvote.com |

Call toll-free |

Complete, sign, date and return your proxy card in the enclosed envelope |

Virtually attend the Annual Meeting and vote your shares |

By order of Omega’s Board of Directors,

C. Taylor Pickett

April 21, 2023

Hunt Valley, Maryland

Table of Contents

|

1 |

|

|

31 |

||

7 |

31 |

|||||

7 |

31 |

|||||

7 |

31 |

|||||

7 |

Proposal 4 – Frequency of Advisory Vote on Executive Compensation |

32 |

||||

Proposal 5 - Approval of Amendment to 2018 Stock Incentive Plan |

33 |

|||||

12 |

42 |

|||||

14 |

42 |

|||||

14 |

43 |

|||||

15 |

Summary of Executive Compensation Program and Governance Practices |

46 |

||||

15 |

50 |

|||||

15 |

51 |

|||||

16 |

54 |

|||||

17 |

61 |

|||||

20 |

62 |

|||||

Communicating with the Board of Directors and the Audit Committee |

23 |

63 |

||||

24 |

64 |

|||||

24 |

64 |

|||||

24 |

65 |

|||||

25 |

67 |

|||||

25 |

68 |

|||||

26 |

69 |

|||||

26 |

70 |

|||||

26 |

70 |

|||||

27 |

73 |

|||||

27 |

75 |

|||||

27 |

77 |

|||||

28 |

78 |

|||||

28 |

78 |

|||||

29 |

80 |

|||||

29 |

80 |

|||||

30 |

80 |

|||||

30 |

i |

|||||

31 |

||||||

31 |

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

Annual Meeting Logistics

|

|

|

||

|

WHEN June 5, 2023 at 10:00 am EDT |

WEBCAST virtualshareholdermeeting.com/OHI2023 |

RECORD DATE April 6, 2023 |

Voting Guide

|

PROPOSAL 1 |

Election of eight Directors The Board of Directors recommends that you vote FOR each director nominee. These individuals bring a range of relevant experiences and overall diversity of perspectives that is essential to good governance and leadership of our company. |

OUR BOARD RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE |

|

PROPOSAL 2 |

Ratification of the selection of Ernst & Young LLP as our independent auditor for fiscal year 2023 The Board of Directors recommends that you vote FOR the ratification of Ernst & Young LLP. We believe Ernst & Young has sufficient knowledge and experience to provide our company with a wide range of accounting services that are on par with the best offered in the industry. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

PROPOSAL 3 |

Advisory Approval of the Company’s Executive Compensation (“Say-on-Pay”) The Board of Directors recommends that you vote FOR this “say-on-pay” advisory proposal because our compensation program attracts top talent commensurate with our peers and reinforces our “Pay for Performance” philosophy. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

PROPOSAL 4 |

ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION (“SAY-ON-FREQUENCY”) The Board of Directors recommends that you vote every ONE YEAR on this “say-on-frequency” advisory proposal. |

OUR BOARD RECOMMENDS A VOTE Of EVERY ONE YEAR FOR THIS PROPOSAL |

|

PROPOSAL 5 |

APPROVAL OF AN AMENDMENT to the 2018 STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER The Board of Directors recommends that you vote FOR the approval of the amendment to the 2018 Stock Incentive Plan. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

Director Election (Page 7) Our Board of Directors currently consists of eight directors.

Our Nominating and Corporate Governance Committee of the Board of Directors has nominated Craig R. Callen, Kapila K. Anand, Dr. Lisa C. Egbuonu-Davis, Barbara B. Hill, Kevin J. Jacobs, C. Taylor Pickett, Stephen D. Plavin, and Burke W. Whitman for re-election as directors. Each of the nominees for re-election is an incumbent director. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy card intend to vote FOR the election of the nominees named above to hold office until the 2023 Annual Meeting or until their respective successors have been duly elected and qualified.

If any nominee becomes unavailable for any reason (which event is not anticipated), the shares represented by the enclosed proxy may (unless the proxy contains instructions to the contrary) be voted for such other person or persons as may be determined by the holders of the proxies.

Below we included selected information regarding each of our eight director nominees for election at the 2023 Annual Meeting.

Name and Principal Occupation |

|

Age |

|

Director |

|

Other Public |

|

Committee Memberships |

||||||

AC |

|

CC |

|

IC |

|

NGC |

||||||||

Craig R. Callen |

67 |

2013 |

|

|

|

|||||||||

Kapila K. Anand |

69 |

2018 |

1 |

|

|

|||||||||

Dr. Lisa C. Egbuonu-Davis |

65 |

2021 |

1 |

|

||||||||||

Barbara B. Hill |

70 |

2013 |

1 |

|

|

|||||||||

Kevin J. Jacobs |

50 |

2020 |

|

|

||||||||||

C. Taylor Pickett |

61 |

2002 |

1 |

|

||||||||||

Stephen D. Plavin |

63 |

2000 |

|

|

||||||||||

Burke W. Whitman |

67 |

2018 |

1 |

|

|

|||||||||

Number of meetings in 2023 |

4 |

3 |

6 |

4 |

||||||||||

AC = Audit Committee |

|

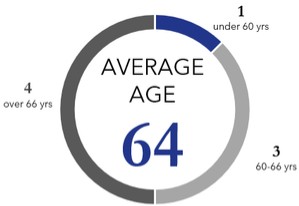

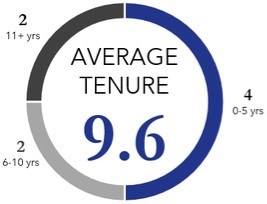

Director Diversity (Page 17)

Below we have included selected information regarding the diversity and skills of our directors, with further explanation included on page 17.

age |

tenure |

gender |

|

|

|

Director Skills and Experience (Page 19)

Below we have included selected information regarding the experience of our directors, with further explanation included on page 19.

of 8 nominees |

|||||||||

leadership |

8 |

||||||||

accounting |

6 |

||||||||

Real estate |

6 |

||||||||

Health care |

6 |

||||||||

sitting executive |

4 |

||||||||

investment |

6 |

||||||||

CYBER |

4 |

||||||||

ESG |

4 |

||||||||

LEGAL/REGULATORY |

2 |

||||||||

HUMAN CAPITAL |

7 |

||||||||

3 |

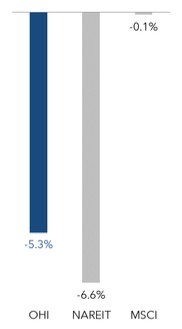

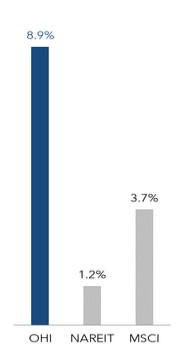

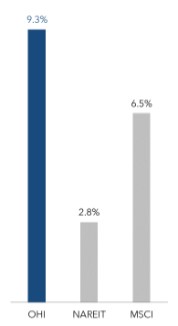

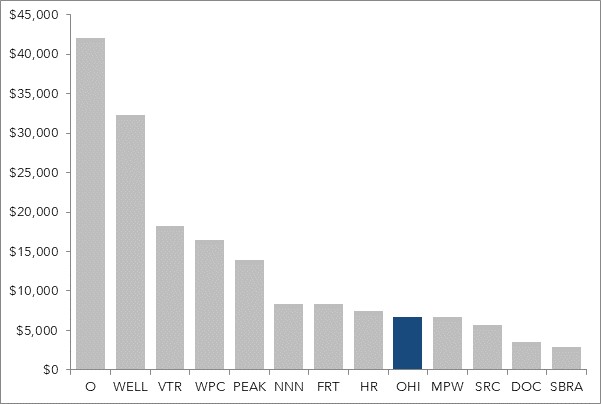

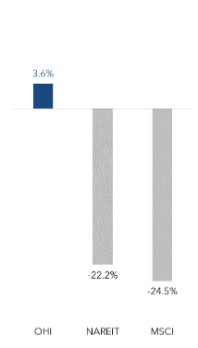

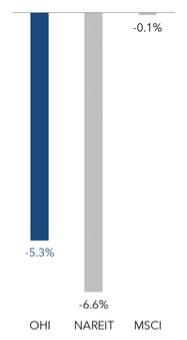

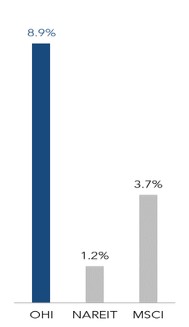

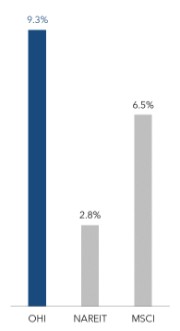

Financial Performance Highlights (Page 42)

Below we have included selected financial performance highlights for the Company as of December 31, 2022.

TOTAL SHAREHOLDER RETURN (“Absolute TSR”) ANNUALIZED PERFORMANCE FOR PERIODS ENDED DECEMBER 31, 2022 | |||

1-YEAR |

3-YEAR |

5-YEAR |

10-YEAR |

|

|

|

|

OHI = Omega Healthcare Investors, Inc. | |||

Absolute TSR figures above are per S&P Global and are calculated using stock/index prices at the beginning and end of the stated period, assuming the reinvestment of dividends.

4 |

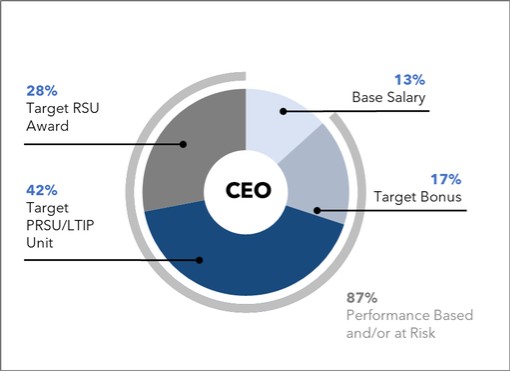

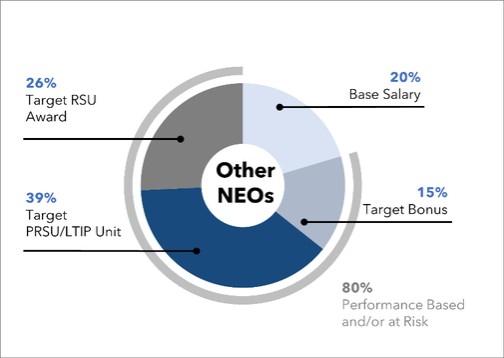

Executive Compensation Highlights (Page 42)

Below we have included selected executive compensation highlights for the Company for fiscal year 2022.

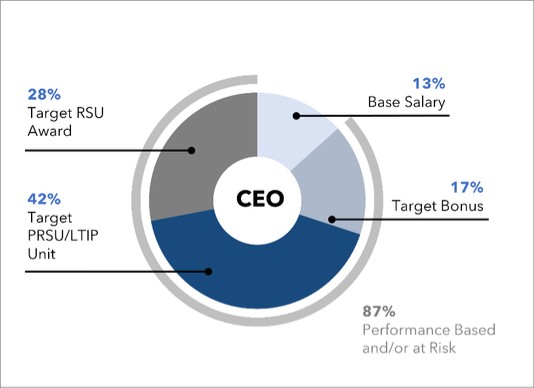

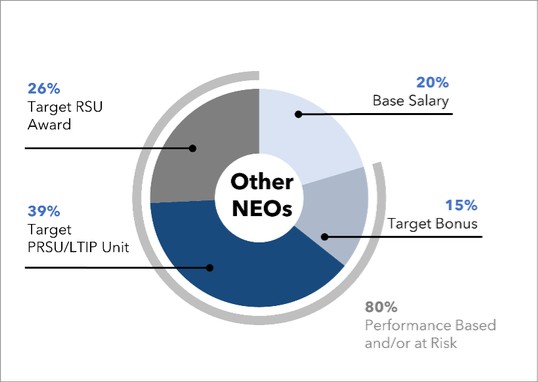

ceo target |

avg. other neos |

|

|

Summary of compensation program

Base |

●

Fixed level of cash compensation to attract and retain key executives in a competitive marketplace

●

Preserves an executive’s commitment during downturns

|

●

Determined based on evaluation of individual executives, compensation, internal pay equity and a comparison to the peer group

|

||||

|

||||||

Annual |

●

Target cash incentive opportunity (set as a percentage of base salary) to encourage achievement of annual Company financial and operational goals

●

Assists in attracting, retaining and motivating executives in the near term

|

●

Majority (70% for 2022) of incentive opportunity based on objective performance measures, which includes FAD per Share, Tenant Quality and Leverage

●

A portion (30% for 2022) of the payout is also based on performance against individual-specific subjective goals

|

||||

|

||||||

Long-Term |

RSUs and Profits Interest Units (Time-based) |

●

Focuses executives on achievement of long-term financial and strategic goals and Absolute and Relative TSR, thereby creating long-term stockholder value

●

Assists in maintaining a stable, continuous management team in a competitive market

●

Maintains stockholder management alignment

●

Easy to understand and track performance

●

Limits dilution to existing stockholders relative to utilizing stock options

|

●

40% of target annual long-term incentive awards in 2022

●

Provides upside incentive in up-market, with some down-market protection

●

Three-year cliff vest (subject to certain exceptions)

|

|||

PRSUs and Profits Interest Units (Performance-based) |

●

60% of target annual long-term incentive award in 2022, requiring significant outperformance to achieve target

●

Three-year performance periods with the actual payout based on Absolute TSR (45%) and Relative TSR performance (55%)

●

Provides some upside in up-or down-market based on relative performance

●

Direct alignment with stockholders

●

Additional vesting once earned (25% per calendar quarter, subject to certain exceptions) for enhanced retention

|

|||||

5 |

|

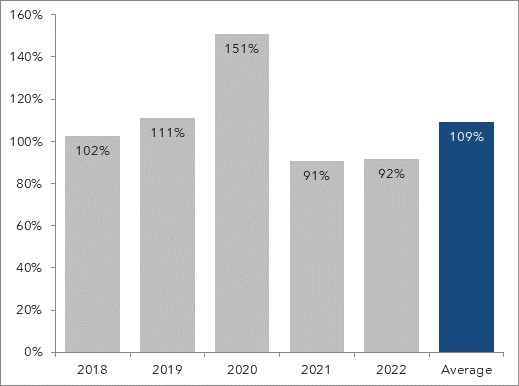

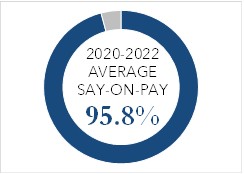

SAY-ON-PAY At our 2022 annual meeting of stockholders, holders of approximately 94.6% of the votes cast on such proposal approved the advisory vote (“say-on-pay”) on the 2021 compensation of our named executive officers, which was consistent with the level of support we received in 2021 and 2020 on our “say-on-pay” proposal and continued a long-term trend of significant shareholder support of 93% or higher in each of the last seven years. The Committee considered the results of the advisory vote when setting executive compensation for 2023 and plans to continue to do so in future executive compensation policies and decisions.

|

|

||

|

CLAWBACK POLICY In 2019, our Board voluntarily adopted a formal clawback policy that applies to incentive compensation. |

Governance Highlights (Page 46)

Below we have included selected governance highlights of the Company.

|

accountability ●

Annual Election of Directors. Our Board consists of a single class of directors who stand for election each year.

●

Proxy Access. Our Bylaws grant stockholders meeting certain eligibility requirements the right to nominate director candidates and require us to include in our proxy materials for an annual meeting stockholder nominated director candidates equal to the greater of two director seats or 20% of the Board.

●

Board Evaluations. Our directors undergo annual evaluations of the Board as a whole and each director individually.

●

Annual Say-on-Pay. We annually submit “say-on-pay” advisory votes for our stockholders’ consideration and vote.

independence ●

Chair and CEO Roles Separated. Our independent Chair of the Board provides independent leadership for our Board.

●

Executive Sessions of Our Board. An executive session of independent directors is generally held at each regularly scheduled Board and Committee meeting.

●

7/8 directors are independent. All of the members of the Board of Directors meet the NYSE listing standards for independence, other than our Chief Executive Officer, Mr. Pickett. Each of the members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee meets the NYSE listing standards for independence.

|

compensation practices ●

Stock Ownership Guidelines. We have stock ownership guidelines for our senior officers and our non-employee directors.

●

Anti-Hedging and Anti-Pledging. Our directors, officers and employees are subject to anti-hedging and anti-pledging policies.

risk management ●

Enterprise Risk Management. Our Board reviews the Company’s risks and enterprise risk management processes at least annually.

●

Cybersecurity Training. We provide cybersecurity training to our directors, officers and employees at least annually.

●

Portfolio & Investment Risk Management

We manage portfolio and investment risk by, among other things, seeking Investment Committee and/or Board approval for new investments over designated thresholds and providing detailed underwriting information on such proposed investments to the Investment Committee or the Board, as the case may be. Environmental, social governance oversight ●

ESG Website. In 2022 we updated our environmental, social responsibility and governance (“ESG“) website that launched in 2021, www.omegahealthcare.com/esg.

●

Diversity & Inclusion. Also in 2022, we continued implementing mandatory diversity and inclusion training for our Board members and employees

|

6 |

Proposal 1 – Election of Directors

|

Vote Required for Election Each director will be elected by of the majority of the votes cast. A “majority of the votes cast” means that the number of the votes cast “FOR” a director exceeds the number of votes “AGAINST.” Abstentions and broker non-votes, if any, will have no effect on the outcome of the election of directors. Your broker may not vote your shares in the election of directors unless you have specifically directed your broker how to vote your shares. As a result, we urge you to instruct your broker how to vote your shares. |

The Board of Directors unanimously recommends a vote FOR the election of each of the director nominees identified below. |

Director Nominees

Our Board of Directors currently consists of eight directors.

Our Nominating and Corporate Governance Committee of the Board of Directors has nominated Craig R. Callen, Kapila K. Anand, Dr. Lisa C. Egbuonu-Davis, Barbara B. Hill, Kevin J. Jacobs, C. Taylor Pickett, Stephen D. Plavin and Burke W. Whitman for re-election as directors. Each of the nominees for re-election is an incumbent director. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy card intend to vote FOR the election of the nominees named above to hold office until the 2024 Annual Meeting or until their respective successors have been duly elected and qualified.

If any nominee becomes unavailable for any reason (which event is not anticipated), the shares represented by the enclosed proxy may (unless the proxy contains instructions to the contrary) be voted for such other person or persons as may be determined by the holders of the proxies.

Information about each director nominee is set forth below.

Craig R. Callen |

||||

|

INDEPENDENT AGE: 67 DIRECTOR SINCE: 2013 |

business experience Mr. Callen was a Senior Advisor at Crestview Partners, a private equity firm, from 2009 through 2016. Previously, Mr. Callen retired as Senior Vice President of Strategic Planning and Business Development for Aetna Inc., where he also served as a Member of the Executive Committee from 2004-2007. In his role at Aetna, Mr. Callen reported directly to the chairman and CEO and was responsible for oversight and development of Aetna’s corporate strategy, including mergers and acquisitions. Prior to joining Aetna in 2004, Mr. Callen was a Managing Director and Head of U.S. Healthcare Investment Banking at Credit Suisse and co-head of Health Care Investment Banking at Donaldson Lufkin & Jenrette. During his 20-year career as an investment banker in the healthcare practice, Mr. Callen successfully completed over 100 transactions for clients and contributed as an advisor to the boards of directors and management teams of many of the leading healthcare companies in the U.S. Mr. Callen has served on the boards of Symbion, Inc. (short-stay surgery facilities), a Crestview portfolio company; Sunrise Senior Living, Inc. (NYSE:SRZ); Kinetic Concepts, Inc. (NYSE:KCI) (a medical technology company); and HMS Holdings Corp. (NYSE:HSMY). Mr. Callen serves as a Trustee of Classical Homes Preservation Trust. |

|||

|

expertise Mr. Callen brings to the Board financial and operating experience as an advisor, investment banker and board member in the healthcare industry. |

OTHER PUBLIC BOARDS ●

Sunrise Senior Living, Inc. (NYSE:SRZ) (1999-2006)

●

Kinetic Concepts, Inc. (NYSE:KCI) (2008-2011)

●

HMS Holdings Corp. (NYSE:HSMY) (2013-2021)

|

|||

7 |

Kapila K. Anand |

||||

|

INDEPENDENT AGE: 69 DIRECTOR SINCE: 2018 |

business experience Ms. Anand served as an audit and later advisory partner at KPMG LLP (“KPMG”) from 1989 until her retirement in March 2016 after which she was retained as a senior advisor to KPMG until 2020. Ms. Anand joined KPMG LLP in 1979 and served in a variety of roles including the National Partner-in-Charge, Public Policy Business Initiatives (from 2008 to 2013) and segment leader for the Travel, Leisure, and Hospitality industry and member of the Global Real Estate Steering Committee (each from 2013 to 2016). In these roles she was involved in numerous risk and governance projects including IT general controls. Ms. Anand has served on KPMG LLP boards in the U.S. and Americas, the board of the Franciscan Ministries (an organization with a range of real estate assets, including schools, churches and hospitals) and as the chair of both the KPMG Foundation as well as the Chicago Network (a membership organization of senior executives). She also previously served as the Global Lead Director for the Women Corporate Directors Education and Development Foundation and served on the board of the U.S. Fund for UNICEF, and currently serves on a variety of non-profit boards, including Rush University Medical Center. Ms. Anand served as a director of Extended Stay America, Inc. (NASDAQ:STAY) from July 2016 through its sale in June 2021, and during that time she chaired the Compensation Committee and also served as a director and Audit Committee Chairwoman of ESH Hospitality, Inc. (a real estate investment trust (“REIT”) subsidiary of Extended Stay America) from May 2017 through June 2021. In September 2018, she joined the Board of Elanco Animal Health, Inc. (NYSE:ELAN), where she chairs the Audit Committee and serves on the Nominating and Governance Committee. She is a Certified Public Accountant, and in 2022 received the Diligent Climate Leadership certification. |

|||

|

expertise Ms. Anand brings to the board extensive experience in accounting and auditing, particularly in the real estate industry, with a focus on Real Estate Investment Trusts, and healthcare industries. |

OTHER PUBLIC BOARDS ●

Elanco Animal Health, Inc. (NYSE:ELAN) (2018-present)

●

Extended Stay America, Inc. (NASDAQ:STAY) (2016-2021)

●

ESH Hospitality, Inc. (a REIT subsidiary of Extended Stay America) (2017-2021)

|

|||

Dr. Lisa C. Egbuonu-Davis |

||||

|

INDEPENDENT AGE: 65 DIRECTOR SINCE: 2021 |

business experience Since 2019, Dr. Egbuonu-Davis has served as Vice President, Medical Innovations for DH Diagnostics, LLC, an affiliate of Danaher Corporation (NYSE:DHR), where she provides medical advice to influence research, partnership and investment strategy across Danaher’s diagnostic platform businesses. Also, during this period, she has served at various times as Interim Chief Medical Officer for certain subsidiaries of Danaher Corporation. From 2015 to 2019, she served as Vice President, Global Patient Centered Outcomes and Solutions at Sanofi, Inc. (NASDAQ:SNY). At Sanofi, Dr. Egbuonu-Davis created patient programs, services and tools to enhance adherence and health outcomes in patients with chronic conditions. Prior to Sanofi, Dr. Egbuonu-Davis co-founded and served as director for ROI Squared, LLC, a privately-held life science company focused on diagnostic medical devices, and served as managing director for LED Enterprise, LLC, where she advised biopharmaceutical companies and trade associations on health care reform, technology assessment, quality metrics and incentives and implications for research and services. She also served in senior advisor roles for Avalere Health and Booz Allen Hamilton. She also previously served for 13 years in various roles at Pfizer, Inc. (NYSE:PFE), where she led clinical and outcomes research departments, supported product value assessments in support of reimbursement and adoption and influenced product investment and development decisions. Dr. Egbuonu-Davis currently serves on the Johns Hopkins Medicine Board of Trustees and the National Advisory Council for the Johns Hopkins University School of Education. In March 2023, she joined the Board of Avanos Medical, Inc. (NYSE:AVNS), a medical device company, and will serve as a member of the compliance and governance committees. |

|||

|

expertise Dr. Egbuonu-Davis brings to the Board broad strategic and operational experience in pharmaceuticals, public health and consulting, including expertise in developing and implementing research, commercialization, and investment strategies for a variety of patient populations in addition to her medical and public health expertise. |

OTHER PUBLIC BOARDS ●

Avanos Medical, Inc. (NYSE:AVNS) (2023-present)

|

|||

8 |

Barbara B. Hill |

||||

|

INDEPENDENT AGE: 70 DIRECTOR SINCE: 2013 |

business experience Ms. Hill is currently an Operating Partner of NexPhase Capital (formerly Moelis Capital Partners), a private equity firm, where she focuses on healthcare-related investments and providing strategic and operating support for NexPhase's healthcare portfolio companies. She began as an Operating Partner of Moelis Capital Partners in March 2011. From March 2006 to September 2010, Ms. Hill served as Chief Executive Officer and a director of ValueOptions, Inc., a managed behavioral health company and FHC Health Systems, Inc., its parent company. Prior to that, from August 2004 to March 2006, she served as Chairman and Chief Executive Officer of Woodhaven Health Services, an institutional pharmacy company. In addition, from 2002 to 2003, Ms. Hill served as President and a director of Express Scripts, Inc. (NASDAQ:ESRX), a pharmacy benefits management company. In previous positions, Ms. Hill was responsible for operations nationally for Cigna HealthCare, and also served as the CEO of health plans owned by Prudential, Aetna and the Johns Hopkins Health System. She was also active with the boards or committees of the Association of Health Insurance Plans and other health insurance industry groups. Since 2013, she has served as a board member of Integra LifeSciences Holdings Corporation (NASDAQ:IART), a medical device and technology company, where she is lead director. She previously served as a board member of Owens & Minor (NYSE:OMI), a healthcare distribution company, from 2017 to August 2019; St. Jude Medical Corporation, a medical device company, from 2007 to January 2017, until its sale to Abbott Labs and Revera Inc., a Canadian company operating over 500 senior facilities throughout Canada, Great Britain and the U.S., from 2010 to March 2017. |

|||

|

expertise Ms. Hill brings to the Board years of experience in operating and serving as a director of healthcare-related companies. |

OTHER PUBLIC BOARDS ●

Integra LifeSciences Holdings Corporation (NASDAQ:IART) (2013–present)

●

Owens & Minor, Inc. (NYSE:OMI) (2017-2019)

|

|||

Kevin J. Jacobs |

|||

|

INDEPENDENT AGE: 50 DIRECTOR SINCE: 2020 |

business experience Mr. Jacobs is Chief Financial Officer and President, Global Development for Hilton Worldwide Holdings, Inc. (“Hilton”) (NYSE:HLT), and leads the company's finance, real estate, development and architecture and construction functions globally. Mr. Jacobs joined the company in 2008 as Senior Vice President, Corporate Strategy; was elected Treasurer in 2009; was appointed Executive Vice President & Chief of Staff in 2012; assumed the role of Chief Financial Officer in 2013; and added the role of President, Global Development in 2020. Prior to Hilton, Mr. Jacobs was Senior Vice President, Mergers & Acquisitions and Treasurer of Fairmont Raffles Hotels International. Prior to Fairmont Raffles, Mr. Jacobs spent seven years with Host Hotels & Resorts, ultimately serving as Vice President, Corporate Strategy & Investor Relations. Prior to Host, Mr. Jacobs had various roles in the Hospitality Consulting Practice of Pricewaterhouse Coopers (“PwC”) and the Hospitality Valuation Group of Cushman & Wakefield. He is also a Trustee of Cornell University and a member of the Dean’s Advisory Board of the Cornell University School of Hotel Administration; is Vice Chairman of the Board of Directors and Treasurer of Goodwill of Greater Washington; and is a Trustee of the Federal City Council. He also serves as Vice Chair of the American Hotel & Lodging Association. |

||

|

expertise Mr. Jacobs brings to the Board significant experience managing both private and public companies in the hospitality and real estate industries, including REITs; knowledge of financial reporting and other regulatory matters; and significant capital markets and real estate investment and management/operational experience. | |||

9 |

C. TAYLOR PICKETT |

||||

|

NON-INDEPENDENT AGE: 61 DIRECTOR SINCE: 2002 |

BUSINESS EXPERIENCE Mr. Pickett has served as Chief Executive Officer of the Company since 2001 and as Director of the Company since May 2002. Mr. Pickett has also served as a member of the board of trustees of Corporate Office Properties Trust (NYSE:OFC), an office REIT focusing on U.S. government agencies and defense contractors, since November 2013. From 1998 to June 2001, Mr. Pickett served as Executive Vice President and Chief Financial Officer of Integrated Health Services, Inc. (NYSE:IHS). From 1993 to 1998, Mr. Picket served as a member of the senior management team of IHS in a variety of positions. Prior to joining IHS, Mr. Pickett held various positions at PHH Corporation and KPMG Peat Marwick. |

|||

|

EXPERTISE As Chief Executive Officer of the Company, Mr. Pickett brings to the Board a depth of understanding of our business and operations, as well as financial expertise in long-term healthcare services, mergers and acquisitions. |

OTHER PUBLIC BOARDS ●

Corporate Office Properties Trust (NYSE:OFC) (2013–present)

|

|||

STEPHEN D. PLAVIN |

||||

|

INDEPENDENT AGE: 63 DIRECTOR SINCE: 2000 |

BUSINESS EXPERIENCE Since December 2012, Mr. Plavin has been a Senior Managing Director of the Blackstone Group. Mr. Plavin currently oversees Blackstone’s commercial real estate lending and debt investing activities in Europe. Previously, from when he joined Blackstone until June 2021, Mr. Plavin was the Chief Executive Officer and a Director of Blackstone Mortgage Trust, Inc. (NYSE:BXMT), an NYSE- listed commercial mortgage REIT that is managed by Blackstone. Prior to joining Blackstone, Mr. Plavin served as CEO of Capital Trust, Inc. (predecessor of Blackstone Mortgage Trust), since 2009. From 1998 until 2009, Mr. Plavin was Chief Operating Officer of Capital Trust and was responsible for all of the lending, investing and portfolio management activities of Capital Trust, Inc. Prior to that time, Mr. Plavin was employed for 14 years with Chase Manhattan Bank and its securities affiliate, Chase Securities Inc. Mr. Plavin held various positions within the real estate finance unit of Chase, and its predecessor, Chemical Bank, and in 1997 he became co-head of global real estate for Chase. Mr. Plavin was also the Chairman of the Board of Directors of WCI Communities, Inc. (NYSE:WCIC), a publicly-held developer of residential communities from August 2009 until it was purchased by Lennar Corporation (NYSE:LEN and LEN.B) in February 2017. |

|||

|

EXPERTISE Mr. Plavin brings to the Board management experience in the commercial real estate lending, banking and mortgage REIT sectors, as well as significant experience in capital markets transactions. |

OTHER PUBLIC BOARDS ●

Blackstone Mortgage Trust (NYSE:BXMT) (2012-2021)

●

WCI Communities, Inc. (NYSE:WCIC) (2009-2017)

|

|||

10 |

BURKE W. WHITMAN |

||||

|

INDEPENDENT AGE: 67 DIRECTOR SINCE: 2018 |

BUSINESS EXPERIENCE Since 2019, Mr. Whitman has served as CEO of Colmar Holdings LLC (a private company) and member of the Board of Directors of Amicus Therapeutics, Inc. (NASDAQ:FOLD) (Audit & Compliance Committee; Nominating & Governance Committee). Previously Mr. Whitman served in business and the military concurrently. In the military, he served as a reserve officer of the U.S. Marine Corps from 1985 to 2018, including full-time active duty from 2009 to 2018 during which he led multiple combat deployments and served as a General Officer and Commanding General. In business, he served as CEO, Board Director and initially COO of Health Management Associates, Inc. (then NYSE:HMA) from 2005 to 2008, CFO of Triad Hospitals (then NYSE:TRI) from 1998 to 2005, and President and Board Director of Deerfield Healthcare (then a private company) from 1994 to 1998. He serves on the Board of Directors of the Marine Corps Heritage Foundation (Chair of the Governance Committee) and the Board of the Nashotah Theological Seminary, and has served previously on the Reserve Forces Policy Board (Advisor to the Secretary of Defense), the Board of Directors of the Toys for Tots Foundation (Chair of the Investment Committee) and the Board of Directors of the Federation of American Hospitals (Chair of the Audit Committee) and the Board of Trustees of the Lovett School, now a Lifetime Trustee. |

|||

|

EXPERTISE Mr. Whitman brings to the Board corporate and military leadership experience, including executive and financial leadership in the healthcare sector. |

OTHER PUBLIC BOARDS ●

Amicus Therapeutics, Inc. (NASDAQ:FOLD) (2019-present)

●

Health Management Associates, Inc. (NYSE:HMA) (2005–2008)

|

|||

11 |

Stock Ownership Information

The following table sets forth information regarding the beneficial ownership of our common stock as of April 6, 2023 for:

| ● | each of our directors and the executive officers appearing in the table under “Executive Compensation Tables and Related Information, Summary Compensation Table” included elsewhere in this Proxy Statement; and |

| ● | all persons known to us to be the beneficial owner of more than 5% of our outstanding common stock. |

Beneficial ownership of our common stock, for purposes of this Proxy Statement, includes shares of our common stock as to which a person has voting and/or investment power, or the right to acquire such power within 60 days of April 6, 2023. Except for shares of restricted stock and unvested units as to which the holder does not have investment power until vesting or as otherwise indicated in the footnotes, the persons named in the table have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them, subject to community property laws where applicable. The “Common Stock Beneficially Owned” columns do not include unvested time-based restricted stock units (“RSUs”), unvested performance-based restricted stock units (“PRSUs”) and deferred stock units under our Deferred Compensation Plan (except to the extent such units vest or the applicable deferral period expires within 60 days of April 6, 2023) or common stock issuable in respect of operating partnership units (“OP Units”) or profits interests in OHI Healthcare Properties Limited Partnership (“Omega OP”). Accordingly, we have provided supplemental information regarding deferred stock units, unvested RSUs, OP Units and earned but not yet vested PRSUs and profits interests in Omega OP (“Profits Interest Units”) under the caption “Other Common Stock Equivalents.” For information regarding unearned, unvested PRSUs and Profits Interest Units for performance periods not yet completed, see “Outstanding Equity Awards at Fiscal Year End” below.

The business address of the directors and executive officers is 303 International Circle, Suite 200, Hunt Valley, Maryland 21030. As of April 6, 2023, there were 234,349,170 shares of our common stock outstanding and no preferred stock outstanding, as well as 8,626,224 common stock equivalents (including OP Units) outstanding, as defined in the table below.

Common Stock |

|||||||||||||||

Beneficially Owned |

Other Common Stock Equivalents |

|

|||||||||||||

Operating |

Percent of Class |

|

|||||||||||||

Number |

Percentage |

Unvested |

Vested Profits |

Deferred |

Partnership |

Including Common |

|

||||||||

Beneficial Owner |

|

of Shares |

|

of Class |

|

Units(1) |

|

Interest Units(2) |

|

Stock Units(3) |

|

Units(4) |

|

Stock Equivalents(5) |

|

Kapila K. Anand |

14,676 |

* |

— |

— |

18,233 |

— |

* |

||||||||

Daniel J. Booth |

195,636 |

* |

140,838 |

— |

— |

256,938 |

0.24% |

||||||||

Craig R. Callen |

50,423 |

* |

13,497 |

10,401 |

54,876 |

13,861 |

* |

||||||||

Dr. Lisa C. Egbuonu-Davis |

8,518 |

(6) |

* |

— |

— |

— |

— |

* |

|||||||

Barbara B. Hill |

31,310 |

* |

8,304 |

6,400 |

— |

11,731 |

* |

||||||||

Steven J. Insoft(7) |

— |

* |

34,926 |

— |

— |

27,867 |

* |

||||||||

Kevin J. Jacobs |

18,016 |

(8) |

* |

— |

— |

— |

— |

* |

|||||||

Gail D. Makode |

1,069 |

* |

59,225 |

— |

— |

14,803 |

* |

||||||||

C. Taylor Pickett |

4,100 |

* |

306,235 |

— |

575,539 |

340,423 |

(9) |

0.50% |

|||||||

Stephen D. Plavin |

94,753 |

(10) |

* |

5,158 |

3,969 |

— |

— |

* |

|||||||

Robert O. Stephenson |

238,968 |

0.10% |

129,545 |

— |

— |

259,173 |

0.26% |

||||||||

Burke W. Whitman |

30,165 |

(6) |

* |

— |

— |

— |

— |

* |

|||||||

Directors, director nominee and current executive officers as a group (12 persons) |

687,634 |

0.29% |

697,728 |

20,770 |

648,648 |

924,796 |

1.23% |

||||||||

5% Beneficial Owners: (11) |

|

|

|

|

|

|

|

||||||||

The Vanguard Group, Inc. |

34,382,537 |

(12) |

14.7% |

— |

— |

— |

14.2% |

||||||||

BlackRock, Inc. |

28,741,936 |

(13) |

12.3% |

11.8% |

|||||||||||

State Street Corporation |

13,185,834 |

(14) |

5.6% |

— |

— |

— |

5.4% |

||||||||

* Less than 0.10%

| (1) | Includes RSUs and earned but unvested PRSUs and Profits Interest Units that in each case vest more than 60 days from April 6, 2023, subject to continued employment. RSUs and time-based Profits Interest Units are subject to additional vesting in connection with a Qualifying Termination or Retirement. Earned but not yet vested PRSUs and performance-based Profits Interest Units held by the executive officers vest quarterly in the year following the end of the applicable performance period subject to continued employment, except in the case of a Qualifying Termination, Retirement or change in control in which case they are also subject to vesting. Each unit represents the right to receive one share of common stock. See “Outstanding Equity Awards at Fiscal Year End.” Unvested Profits Interest Units held by the directors other than Mr. Pickett vest upon completion of the current one-year term, subject to accelerated vesting in connection with death, disability of change in control. |

| (2) | Includes earned but unvested Profits Interest Units that are scheduled to vest within 60 days from April 6, 2023, subject to continued service, but which can be converted to OP units if certain tax-related conditions are met. |

| (3) | Deferred stock units representing the deferral of vested equity awards pursuant to the Company’s Deferred Stock Plan. Includes deferred stock units associated with RSUs and PRSUs vesting within 60 days which the holder has elected to defer. The deferred stock units will not be converted until the date or event specified in the applicable deferred stock agreement. See “Nonqualified Deferred Compensation.” |

12 |

| (4) | OP Units are redeemable at the election of the holder for cash equal to the value of one share of our common stock priced at the average closing price for the 10-day trading period ending on the date of the holder’s notice of election to redeem the OP Units, subject to the Company’s election to exchange the OP Units tendered for redemption for shares of Omega common stock on a one-for-one basis, in each case subject to adjustment. |

| (5) | Percent of class reflects 234,349,170 shares of common stock outstanding as of April 6, 2023, plus a total of 8,626,224 common stock equivalents, consisting of 983,826 unvested RSUs and Profits Interest Units, 648,648 deferred stock units, approximately 6,972,980 OP Units and approximately 20,770 vested Profits Interest Units. |

| (6) | Includes 5,131 shares of restricted stock, subject to forfeiture until vested. |

| (7) | Mr. Insoft’s employment terminated effective January 1, 2022. |

| (8) | Includes 8,381 shares of restricted stock, subject to forfeiture until vested. |

| (9) | Excludes 225,000 OP Units that Mr. Pickett gifted an irrevocable trust for the benefit of his spouse and son on September 3, 2021, over which Mr. Pickett has no voting power. |

| (10) | Includes 34,306 shares of common stock that are held by a limited liability company, of which the reporting person is the manager. |

| (11) | Except as otherwise indicated below, information regarding 5% beneficial owners is based on information reported on Schedule 13G filings by the beneficial owners indicated with respect to the common stock of Omega. |

| (12) | Based on a Schedule 13G/A filed with the SEC on February 9, 2023 by The Vanguard Group, Inc., including on behalf of certain subsidiaries. The Vanguard Group, Inc. is located at 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group, Inc. has shared voting power with respect to 292,084 of the shares, sole dispositive power with respect to 33,859,699 of the shares and shared dispositive power with respect to 522,838 of the shares. |

| (13) | Based on a Schedule 13G/A filed with the SEC on January 23, 2023 by BlackRock, Inc., including on behalf of certain subsidiaries. BlackRock, Inc. is located at 55 East 52nd Street, New York, NY 10055. BlackRock, Inc. has sole voting power with respect to 27,279,615 of the shares and sole dispositive power with respect to 28,741,936 of the shares. |

| (14) | Based on a Schedule 13G/A filed with the SEC on February 10, 2023 by State Street Corporation including on behalf of certain subsidiaries. State Street Corporation. Is located at State Street Financial Center, 1 Lincoln Street, Boston, MA 02111. State Street Corporation has shared voting power with respect to 9,855,937 of the shares and shared dispositive power with respect to 13,185,834 of the shares. |

13 |

Board Committees and Corporate Governance

Board of Directors and Committees of the Board

The members of the Board of Directors on the date of this Proxy Statement and the Committees of the Board on which they serve are identified below.

|

Name |

Committee Memberships |

||||||||

Audit |

Compensation |

Investment |

Nominating & |

|||||||

|

Craig R. Callen |

|

|

|

||||||

|

Kapila K. Anand |

|

|

|||||||

|

Dr. Lisa C. Egbuonu-Davis |

|

||||||||

|

Barbara B. Hill |

|

|

|||||||

|

Kevin J. Jacobs |

|

|

|||||||

|

C. Taylor Pickett |

|

||||||||

|

Stephen D. Plavin |

|

|

|||||||

|

Burke W. Whitman |

|

|

|||||||

Number of meetings in 2022 |

4 |

3 |

6 |

4 |

||||||

|

|

|

14 |

The Board of Directors held seven meetings during 2022. Each member of the Board of Directors attended more than 75% of the meetings of the Board of Directors and of the committees of which such director was a member in 2022. While we invite our directors to attend our annual meeting of stockholders, the Company currently does not have a formal policy regarding director attendance. Mr. Pickett chaired Omega’s 2022 annual meeting of stockholders, and a total of five (5) members of our Board of Directors participated virtually in our 2022 annual meeting of stockholders.

Director Independence

All of the members of the Board of Directors meet the NYSE listing standards for independence, other than our Chief Executive Officer, Mr. Pickett. While the Board of Directors has not adopted any categorical standards of independence, in making these independence determinations, the Board of Directors noted that no director other than Mr. Pickett (a) received direct compensation from our Company other than director annual retainers and meeting fees, (b) had any relationship with our Company or a third party that would preclude independence or (c) had any material business relationship with our Company and its management, other than as a director of our Company. Each of the members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee meets the NYSE listing standards for independence.

Board Leadership Structure

Since 2001, an independent non-employee director has served as our Chair of the Board of Directors rather than the Chief Executive Officer. We separate the roles of Chief Executive Officer and Chair of the Board in recognition of the difference between the two roles. At this time, the Board believes this leadership structure is appropriate, as it allows the Chief Executive Officer to focus on implementing the strategic direction for the Company as approved by the Board of Directors and the management of the day-to-day operations of the Company, while the Chair of the Board provides guidance to the Chief Executive Officer and sets the agenda for and presides over meetings of the Board. Mr. Callen, as Chair of the Board, presides over any meeting, including regularly scheduled executive sessions of the non-employee directors. If Mr. Callen is not present at such a session, the presiding director is chosen by a vote of those present at the session.

Risk Oversight

The Board of Directors, as a whole and at the committee level, plays an important role in overseeing the management of risk. Management is responsible for identifying the significant risks facing the Company, implementing risk management strategies that are appropriate for the Company’s business and risk profile, integrating consideration of risk and risk management into the Company’s decision-making process and communicating information with respect to material risks to the Board or the appropriate committee.

Portfolio and investment risk is one of the principal risks faced by the Company. We manage portfolio and investment risk by, among other things, seeking Investment Committee and/or Board approval for new investments over designated thresholds and providing detailed underwriting information on such proposed investments to the Investment Committee or the Board, as the case may be. In addition, our full Board regularly reviews the performance, credit information and coverage ratios of our operators.

Consistent with the rules of the NYSE, the Audit Committee reviews and discusses with management, periodically, as appropriate, policies with respect to risk assessment and risk management, the Company’s financial risk exposures and the steps management has taken to monitor and control such exposures, it being understood that it is the job of management to assess and manage the Company’s exposure to risk and that the Audit Committee’s responsibility is to discuss guidelines and policies by which risk assessment and risk management are undertaken. The Audit Committee also monitors the implementation and administration of the Company’s Code of Business Conduct and Ethics and disclosure controls.

The Vice President of Information Technology, who reports directly to the Company’s Chief Financial Officer, oversees our information security program, which is designed to align to industry recognized cybersecurity frameworks. In addition, we maintain an Information Security Incident Response Plan, conduct cybersecurity training for all employees at least annually and conduct training through our cyber insurance carrier, and periodic assessments by third parties to assess our vulnerability management and security controls and to assist us in identifying and mitigating security risks. The Audit Committee reviews and discusses with management quarterly the Company’s program, policies and procedures related to information security and data protection, including data privacy and network security, as they relate to financial reporting, while the Board periodically reviews these cyber-related risks as they impact the enterprise at large.

The Compensation Committee reviews risks associated with the Company’s compensation plans and arrangements. The Nominating and Corporate Governance Committee reviews risks associated with the Company's ESG program. While each committee monitors certain risks and the management of such risks, the full Board is regularly informed about such matters.

15 |

The full Board generally oversees enterprise risk management and enterprise risk management issues otherwise arising in the Company’s business and operations.

selected areas of board and committee oversight in 2022 | ||

|

Corporate Strategy

|

Portfolio Management

|

Enterprise Risk Management

|

|

Privacy and Data Security

|

Code of Business

|

Board and Executive

|

|

ESG/ D&I

|

Board and Executive Succession

|

Investment Activity

|

Areas of Oversight |

|

Audit |

|

Compensation |

|

Nominating & |

|

Investment |

|

Full |

Corporate Strategy |

|

|||||||||

Portfolio Management |

|

|||||||||

Enterprise Risk Management |

|

|||||||||

Privacy and Data Security |

|

|||||||||

Code of Business |

|

|

||||||||

Board and Executive |

|

|

||||||||

ESG/D&I |

|

|

||||||||

Board and Executive Succession |

|

|

||||||||

Investment Activity |

|

|

Standing Committee Information

The Audit Committee met four times in 2022. Its primary function is to assist the Board of Directors in fulfilling its oversight responsibilities with respect to: (i) the financial information to be provided to stockholders and the SEC; (ii) the system of internal controls that management has established and (iii) the external independent audit process. In addition, the Audit Committee selects Omega’s independent auditors and provides an avenue for communication between the independent auditors, financial management and the Board of Directors. The responsibilities of the Audit Committee are more fully described in its Charter, which is available on our website at www.omegahealthcare.com.

Each of the members of the Audit Committee is independent and financially literate, as required of audit committee members by the NYSE. The Board of Directors has determined that Ms. Anand, Mr. Jacobs and Mr. Whitman each qualify as an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC. The Board of Directors has determined that (i) Ms. Anand qualifies as an audit committee financial expert based on her substantial

16 |

experience in accounting and auditing as a partner of KPMG and as a public company audit committee member, (ii) Mr. Whitman qualifies as an audit committee financial expert based on his substantial financial management experience in the healthcare sector, including as a public company chief financial officer and chief executive officer and (iii) Mr. Jacobs qualifies as an audit committee financial expert based on his substantial financial management experience, including as a public company chief financial officer.

The Compensation Committee has responsibility for determining the compensation of our executive officers and administering our equity incentive plan. During 2022, the Compensation Committee met three times. The responsibilities of the Compensation Committee are more fully described in its Charter, which is available on our website at www.omegahealthcare.com.

The Investment Committee works with management to develop strategies for growing our portfolio and has authority to approve investments up to established thresholds. The Investment Committee met six times during 2022.

The Nominating and Corporate Governance Committee met four times during 2022. The Nominating and Governance Committee has responsibility for identifying potential nominees to the Board of Directors and reviewing their qualifications and experience, for developing and implementing policies and practices relating to corporate governance, and for overseeing the Company’s progress on ESG and human resources initiatives. The responsibilities of the Nominating and Corporate Governance Committee are more fully described in its charter, which is available on our website at www.omegahealthcare.com.

In addition to the standing Committees listed above, the Board has established a Special Administrative Committee under the Company’s equity incentive plan consisting solely of Mr. Pickett, with the authority to allocate and grant awards thereunder to employees of Omega and its affiliates who are not executive officers of Omega up to a maximum number of units or shares authorized by the Compensation Committee from time to time. In addition, the Board has formed, and may from time to time form, such other committees as it deems appropriate to fulfill its responsibilities, including to execute capital markets and other activity.

Identification of Director Nominees and Board Diversity

The process for identifying and evaluating nominees to the Board is initiated by identifying candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board of Directors and, if the Nominating and Corporate Governance Committee deems appropriate, a third-party search firm. Nominees for director are selected based on their depth and breadth of experience, industry experience, financial background, integrity, ability to make independent analytical inquiries and willingness to devote adequate time to director duties, among other criteria.

17 |

In addition, the Nominating and Corporate Governance Committee endeavors to identify nominees that possess diverse educational backgrounds, business experiences, life skills, as well as diverse gender, racial, sexual orientation, national origin and ethnic characteristics.

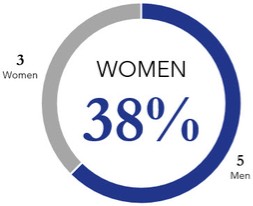

OVERALL |

gender |

|||||

3 Women |

38% |

|

||||

TENURE |

AGE |

|||||

|

|

|||||

18 |

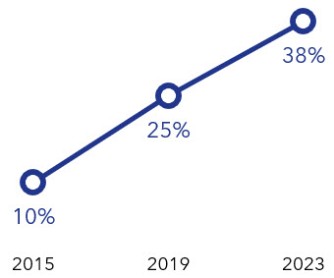

38% of our Board nominees are women, and two nominees bring racial diversity to our Board. Also, the director nominees range in age from 50 to 70 with the average age being 64. Four of our Board members were first elected to our Board in or after 2018. The Nominating and Corporate Governance Committee does not assign specific weight to any particular criteria; the goal is to identify nominees that, considered as a group, will possess an effective mix of backgrounds, talents, knowledge, skill sets and characteristics necessary for the Board of Directors to fulfill its responsibilities.

The table below provides a summary of certain of these collective competencies and attributes of the Board nominees. The lack of an indicator for a particular nominee does not mean that the director does not possess that skill or experience, as we look to each director to be knowledgeable in all of these areas. Rather, the indicator represents that the item is a core competency that the director brings to the Board.

Anand |

Callen |

Egbuonu- |

Hill |

Jacobs |

Pickett |

Plavin |

Whitman |

Total |

Percentage |

|||

Skills/ Experience |

Leadership |

● |

● |

● |

● |

● |

● |

● |

● |

8 |

100% |

|

Accounting |

● |

● |

● |

● |

● |

● |

6 |

75% |

||||

Real Estate |

● |

● |

● |

● |

● |

● |

6 |

75% |

||||

Health Care |

● |

● |

● |

● |

● |

● |

6 |

75% |

||||

Sitting Executive |

● |

● |

● |

● |

4 |

50% |

||||||

Investment |

● |

● |

● |

● |

● |

● |

6 |

75% |

||||

Cybersecurity |

● |

● |

● |

● |

4 |

50% |

||||||

ESG |

● |

● |

● |

● |

4 |

50% |

||||||

Legal/Regulatory |

● |

● |

2 |

25% |

||||||||

Human Capital Management |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

|||

Attributes |

Racial Diversity: |

|||||||||||

African American |

● |

1 |

13% |

|||||||||

Asian/Pacific Islander |

● |

1 |

13% |

|||||||||

White/Caucasian |

● |

● |

● |

● |

● |

● |

6 |

75% |

||||

Hispanic/Latino |

||||||||||||

Native American |

||||||||||||

Other |

||||||||||||

Gender Diversity: |

||||||||||||

Male |

● |

● |

● |

● |

● |

5 |

63% |

|||||

Female |

● |

● |

● |

3 |

38% |

|||||||

Other |

||||||||||||

Independence: |

||||||||||||

Independent Director |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

|||

Non-Independent Director |

● |

1 |

13% |

|||||||||

Military Status: |

||||||||||||

Veteran |

● |

1 |

13% |

|||||||||

Non-Veteran |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

Our directors have a wide range of additional skills and experience not mentioned above, which they bring to their roles as directors to Omega’s benefit, including experience in the financial services industry, corporate governance, and nonprofit leadership areas. The term “Sitting Executive” above refers to a director’s current position in an executive role for a publicly-traded company or its subsidiary. Racial and gender diversity attributes are based on self-identified attributes of our directors. Expertise in cybersecurity, ESG, legal/regulatory and human capital management reflect a director’s belief that they have overseen or otherwise developed expertise in such areas. Our directors’ skills and experience are further described in their

19 |

biographies above. The Nominating and Corporate Governance Committee will consider written proposals from stockholders for nominees as director. Any such nomination should be submitted to the Nominating and Corporate Governance Committee through our Secretary in accordance with the procedures and time frames described in our Bylaws.

Environmental, Social and Governance Oversight

In connection with internal assessments and stockholder engagement, we prioritize ESG initiatives that matter most to our business and stockholders. Our Nominating and Corporate Governance Committee has been charged with oversight of the Company’s ESG efforts; however, ESG remains the responsibility and focus of our entire Board. In 2020, we published our first Corporate ESG Summary, and in 2021 we launched our ESG website, available at www.omegahealthcare.com.

esg focus areas | ||

|

|

|

|

Environmental

|

Social |

Governance

|

|

●

Efficient Corporate Headquarters Building and Proactive Green Strategies

●

Supporting Tenant Programs

●

ESG Website and Report

|

●

Equal Opportunity and Diversity and Inclusion

●

Employee Development and Growth

●

Supporting Community Involvement

|

●

Separate CEO and Chair

●

Proactively Adopted Proxy Access

●

Strong Alignment of Pay for Performance

|

|

ENVIRONMENTAL RESPONSIBILITY |

We place a high priority on the protection of our assets, communities and the environment. Based on our business model, the properties in our portfolio are primarily net leased to our tenants, and each tenant is generally responsible for maintaining the buildings, including controlling their energy usage and the implementation of environmentally sustainable practices at each location. We support our tenants’ operations and work with them to promote environmental responsibility at the properties we own and to reiterate the importance of energy efficient facilities, including by:

| ● | providing capital to our operators to add or upgrade to energy-efficient emergency power generators to limit disruption to patient care in the event of a power outage; |

| ● | supporting compliance with prevailing environmental laws and regulations throughout our new development, major renovation and capital expenditure projects; and |

| ● | promoting the adoption of specific environmental practices in our sustainable and innovative new developments, including, but not limited to, the installation of occupancy sensors and water-efficient plumbing fixtures, the use of low VOC paints and adhesives and the use of energy-efficient lighting, with 56% of Omega’s development from 2015 to 2022 having been built to Leadership in Energy and Environmental Design (“LEED”) certification standards. |

|

Corporate HQ LEED Certified Our focus on environmental responsibility is also demonstrated by how we manage our day-to-day activities at our corporate headquarters, which has earned the LEED Silver Certification in Existing Buildings: Operations & Maintenance, and where we also promote energy efficiency with features such as an automatic lighting control system, water efficient features, low-VOC paints and floor adhesives and a single-stream recycling service. |

56% of Omega’s development projects from 2015-2022 built to LEED certification standards |

||

20 |

|

SOCIAL RESPONSIBILITY, EQUAL OPPORTUNITY AND DIVERSITY AND INCLUSION |

We are committed to providing a positive and engaging work environment for our employees and taking an active role in the betterment of the communities in which our employees live and work. Our employees are provided a competitive benefits program, including comprehensive healthcare benefits and a 401(k) plan with a matching contribution from the Company, the opportunity to participate in our employee stock purchase program, bonus and incentive pay opportunities, competitive paid time-off benefits and paid parental leave, wellness programs, continuing education and development opportunities and periodic engagement surveys. In addition, we believe that giving back to our community is an extension of our mission to improve the lives of our stockholders, our employees and our employees’ families, and we have implemented community engagement events, internship and mentorship programs, as well as a matching program for charitable contributions of employees.

|

ACTION ON PAY EQUITY AND DIVERSITY AND INCLUSION Omega has a long-standing commitment to being an equal opportunity employer and has implemented Equal Employer Opportunity policies. We regularly conduct pay equity reviews as we seek for women and men, on average, at various roles and levels of the Company, to be paid equitably for their roles and contributions to our success. Additionally, in 2021, we reinforced our diversity and inclusion commitment by signing the CEO Action for Diversity and Inclusion Pledge, one of the largest CEO-driven business commitments to act on and advance diversity, equity and inclusion in the workplace. In addition, beginning in 2020, we have implemented several initiatives to further our commitment to diversity and inclusion within our workforce and Board, in our local community and in the industry in which we operate, particularly considering the racial and social justice challenges that were highlighted in 2020 and during the pandemic.

We have committed as a Founding Donor to support Nareit’s Dividends Through Diversity, Equity & Inclusion program, which supports charitable and educational organizations and initiatives that will help create a more diverse, equitable, and inclusive REIT and publicly traded real estate industry. Members of management serve on Nareit’s Corporate Governance Council and Real Estate Sustainability Council. |

In 2022 Omega committed as a Founding Donor of Nareit’s Dividends Through Diversity, Equity & Inclusion program |

||

diversity and inclusion initiatives designed to impact:

|

Workforce and Board Recruitment & Internships |

We have expanded our recruitment practices to reach more diverse candidates for employment and Board positions and have developed an internship program with a focus on increasing diversity in the pipeline of eligible employees. In addition, the Company implements mandatory diversity and inclusion training for our Board members and employees. Three of our eight Board nominees are women, two of whom are racial minorities and one of whom is from a historically underrepresented group. At the executive level, one of the Company’s four NEOs is a woman and brings racial diversity to the team, and on the senior management team, 20% are women and 20% bring racial diversity to the team. In 2020, our CEO reinforced our diversity and inclusion commitment by signing the CEO Action for Diversity and Inclusion Pledge, one of the largest CEO-driven business commitments to act on and advance diversity, equity and inclusion in the workplace. |

|

|

local community Charitable Partnerships |

We have invested in several local charitable partnerships to improve economic, health and social outcomes in the local Baltimore, Maryland community, with a focus on the local Black community and historically underrepresented communities. |

21 |

|

industry Fostering Operator Training Scholarships |

We are providing grants for operator training programs that focus on development of talent from historically underrepresented communities and have initiated a multi-year scholarship program at a local historically Black university. We have also implemented a Vendor Code of Conduct aimed at improving corporate social responsibility among our key vendors and aligning their practices with our policies. |

|

Corporate Governance |

Omega maintains a commitment to high corporate governance standards. We believe that sound corporate governance strengthens the accountability of our Board and management and promotes the long-term interest of stockholders. The bullets below highlight areas of our governance practices, which should be read in conjunction with the information set forth above and in our Corporate Governance Guidelines available through our website at www.omegahealthcare.com.

BOARD STRUCTURE |

|

Annual Election of Directors. Opt-out of Maryland Law Allowing Staggering the Board without Shareholder Approval. |

|

Majority Voting Standard for Director Elections with Resignation Policy. Chair and CEO Roles Separated. |

STOCKHOLDER RIGHTS |

Proxy Access. |

Stockholder-Requested Special Meetings. Stockholder Amendments to Bylaws. |

||

COMPENSATION PRACTICES |

Stock Ownership Guidelines. Anti-Hedging and Anti-Pledging. |

Clawback Policy. Annual Say-on-Pay. |

22 |

BOARD PRACTICES |

Annual Strategic Review. Executive Sessions of Our Board. |

Board Evaluations. Regular Succession Planning. |

ethics and risk management |

|

Code of Ethics. Whistleblower Policy. |

|

Enterprise Risk Management. Cybersecurity Training. |

ESG AND DIVERSITY AND INCLUSION |

ESG Steering Committee. |

Training. |

Communicating with the Board of Directors and the Audit Committee

Our Board of Directors and our Audit Committee have established procedures to enable anyone who has a concern about our conduct, or any employee who has a concern about our accounting, internal controls or auditing matters, to communicate that concern directly to the non-employee members of the Board of Directors or the Audit Committee, as applicable. These communications may be confidential or anonymous and may be submitted in writing, by a toll-free telephone hotline administered via a third party or through the Internet, including through a third-party administered website. Our employees have been provided with direct and anonymous access to each of the members of the Audit Committee. Our Company Code of Ethics prohibits any employee of our Company from retaliating or taking adverse action against anyone in good faith raising or helping resolve a concern about our Company.

23 |

Interested parties may contact our non-employee directors by writing to them at our headquarters: Omega Healthcare Investors, Inc., 303 International Circle, Suite 200, Hunt Valley, Maryland 21030, or by contacting them through our website at www.omegahealthcare.com. Communications addressed to the non-employee members of the Board of Directors will be reviewed by Omega’s Chief Legal Officer and General Counsel, as corporate communications liaison, and will be directed to the appropriate director or directors for their consideration. The Chief Legal Officer and General Counsel may not “filter out” any direct communications from being presented to the non-employee members of the Board of Directors and Audit Committee members without instruction from the directors or committee members. The corporate communications liaison is required to maintain a record of all communications received that were addressed to one or more directors, including those determined to be inappropriate communications. Such record will include the name of the addressee, the disposition by the corporate communications liaison and, in the case of communications determined to be inappropriate, a brief description of the nature of the communication. The corporate communications liaison is required to provide a copy of any additions to the record upon request of any member of the Board of Directors.

Policy on Related Party Transactions

We have a written policy regarding related party transactions under which we have determined that we will not engage in any purchase, sale or lease of property or other business transaction in which our officers or directors have a direct or indirect material interest without the approval by resolution of a majority of those directors who do not have an interest in such transaction. It is generally our policy to enter into or ratify related party transactions only when our Board of Directors, acting through our Audit Committee, determines that the related party transaction in question is in, or is not inconsistent with, our best interests and the interests of our stockholders.

Code of Business Conduct and Ethics

We have adopted a written Code of Ethics that applies to all our directors and employees, including our Executive Officers. A copy of our Code of Ethics is available on our website at www.omegahealthcare.com. Any amendment to our Code of Ethics or any waiver of our Code of Ethics will be disclosed on our website at www.omegahealthcare.com promptly following the date of such amendment or waiver. We provide regular training to our directors, officers, and employees on the Code of Ethics.

Stock Ownership Guidelines

The Board of Directors has adopted stock ownership guidelines to foster long-term stock holdings by Company leadership. These guidelines create a strong link between stockholders’ and management’s interest. The Chief Executive Officer is required to own shares in the Company with a value equal to at least six times his annual base salary. Executive Officers other than our Chief Executive Officer are required to own shares in the Company with a value equal to at least three times their respective annual base salaries within five years of the executive’s appointment. Each non-employee director is required to own shares in the Company with a value equal to at least five times the annual cash retainer for serving as a member of the Board of Directors within five years of the director’s appointment. The complete Stock Ownership Guidelines for Executive Officers and Directors (the “Stock Ownership Guidelines”) contained in the Corporate Governance Guidelines are available through our website at www.omegahealthcare.com.

24 |

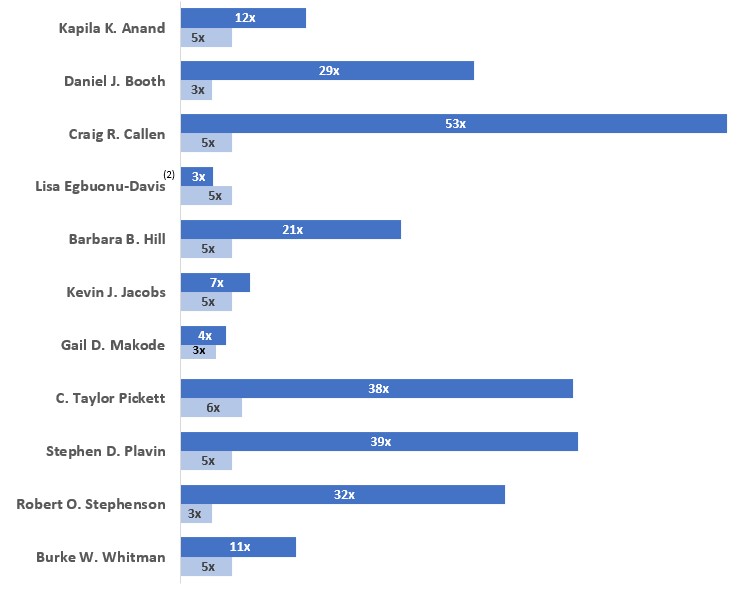

The following graph summarizes the stock ownership of each of the officers above and our non-employee directors as of April 6, 2023, as a multiple of base salary or annual cash retainer, respectively, then in effect, pursuant to our Stock Ownership Guidelines.

STOCK OWNERSHIP GUIDELINES DATA AS OF APRIL 6, 2023 (1)

| (1) | Ownership multiples are based on actual ownership as of April 6, 2023. Ownership multiples above are shown for illustrative purposes and may be less than the valuations provided for in the Stock Ownership Guidelines. Once an officer or director complies with the applicable guidelines, a subsequent decline in stock price has no effect on compliance. |

| (2) | Dr. Egbuonu-Davis, who was appointed to the Board in 2021 has not yet reached the five-year tenure threshold to satisfy the ownership requirement. |

Policy on Hedging and Pledging of Company Securities

We consider it inappropriate for any director or officer to enter into speculative transactions in our Company’s securities. Therefore, we prohibit the purchase or sale of puts, calls, options or other derivative instruments related to our Company’s securities or debt. Our policy also prohibits hedging or monetization transactions, such as forward sale contracts, in which the stockholder continues to own the underlying security without all the risks or rewards of ownership.

Additionally, directors and officers may not purchase our Company’s securities on margin, hold our securities in a margin account or pledge the Company’s securities as collateral. All of our directors and officers are in compliance with this policy as of April 6, 2023.

Director Retirement Policy

It is the general policy of the Board of Directors that after reaching 77 years of age, directors shall not stand for re-election and thereafter shall retire from the Board of Directors upon the completion of the term of office to which they were elected. On the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors may waive this requirement as to any director if it deems such waiver to be in the best interests of the Company.

25 |

Director Over-Boarding Policy