Discussion of approach to measuring, incentivizing, and improving sustainability impacts of tenants

As a triple-net landlord, our third-party operators have control and responsibility for the properties in our real estate portfolio on a day-to-day basis. While our ability to mandate environmental changes to their operations is limited, our tenants are contractually bound to preserve and maintain our properties in good working order and condition. In connection with this, they are generally required to meet or exceed annual expenditure thresholds on capital improvements and enhancements of our properties. Compliance with this requirement alone, in certain cases, produces improvements in the environmental performance of our properties and reduces energy usage, water usage, and direct and indirect greenhouse gas (GHG) emissions.

Our asset management team seeks to monitor and enforce these contractual requirements, through both Omega personnel and third-party inspectors periodically visiting our properties. These visits focus on ensuring that our properties are being suitably maintained and sometimes result in corrective repair and replacement recommendations. We require that these corrections and replacements comply with local building codes, which often results in the incorporation of sustainable improvements into our properties.

Omega has implemented a capital expenditure sustainability initiative to encourage operators to invest in financially beneficial and environmentally enhancing investment projects. The idea is to financially incentivize operators, through discounts on our standard cost of capital, to invest in sustainable capital projects that provide a favorable return on investment while reducing the environmental footprint of these operations. We have engaged third party consultants to provide recommendations as to what investments provide this combination of economic and environmental benefit. However, we have also encouraged our operators to propose their own suggestions, which we will evaluate based on the extent of the environmental impact. Finally, given the broad geographic dispersion and general lack of direct competition that exists among many of our operators, we are encouraging them to share environmental best practices. Further, we expect to showcase some of these environmental investments at our operator conference, which is generally held biennially, to highlight ways in which financial and environmental efforts can be aligned.

Discussion and analysis on use of Phase I and Phase II Environmental Site Assessments (ESAs)

As a triple-net landlord, our third-party operators have control and responsibility for the properties in our real estate portfolio. Our due diligence on all real estate acquisitions includes Phase I and, where appropriate, Phase II environmental assessments (ESAs) as part of our analysis to understand the environmental condition of the property, including whether there is indication of any release of hazardous substances, chemical or waste storage, or other environmental concerns or risks, and to determine whether the property meets certain environmental standards. In the event that our due diligence uncovers environmental contamination, we work with the sellers and/or operators to mitigate any issues.

Because our portfolio is primarily comprised of SNFs, the operations in our facilities are also subject to stringent health regulation and oversight by state regulators, which lowers the risk of environmental contamination onsite.

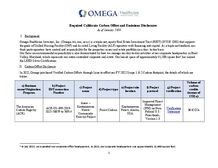

| Year |

2022 |

2023 |

2024 |

| Percentage of leases or agreements that contain provisions requiring compliance with applicable health and safety laws |

100% |

100% |

100% |

| Developments built to LEED/green certification standards (%) |

81% |

86% |

99% |

All of our leases or agreements contain provisions requiring compliance with applicable health and safety laws. In addition, since 2015, 60% of Omega’s development capital has been allocated to facilities built to LEED certification standards.

Physical Climate Risk

Discussion and analysis of physical climate risk to properties and insurance requirements

We regularly monitor the impact of significant natural disasters on our properties. In most leases our tenants are required to carry full replacement cost coverage on all improvements located on our properties. For those properties located in a nationally designated flood zone, we typically require our tenants to carry flood insurance pursuant to the federal flood insurance program. For those properties located in an area of high earthquake risk, we typically require our tenants to carry earthquake insurance above what is traditionally covered in an extended coverage policy.

Area of properties/facilities located in FEMA designated 100-year flood zones, by property subsector1

[IF-RE-450a.1]

For 2024, approximately 6% of properties were located in 100 Year Flood Zones. Of these properties, 83% are SNFs. Put another way, in 2043, about 5% of annualized rent and about 4% of gross real estate investment balance were located in these defined at-risk geographies.

Our corporate goal is to derive less than 10% of rental income from properties in FEMA designated 100-year flood zones.

Description of climate change risk exposure analysis, degree of systematic portfolio exposure, and strategies for mitigating risks

[IF-RE-450a.2]

During the due diligence process, we seek to evaluate the risk of physical, natural disaster or extreme weather patterns on the properties we are looking to acquire and whether there are specific risks to that property or region that need to be mitigated. Through insurance and property- specific safety measures - for example, hurricane shutters, earthquake-compliant construction, elevated generators - we seek to ensure that the real estate is both protected and fit for purpose.

- 100-year flood zones are defined as land areas subject to a one percent or greater chance of flooding in any given year. For properties located in the U.S., 100-year flood zones shall include those land areas designated by the U.S. Federal Emergency Management Agency (FEMA) as special flood hazard areas (SFHA).